2025-06-26 18:31:05

Dear Customers:

Thank you for choosing BOCI Securities Limited (the "Company") as your investment partner!

Hong Kong Securities Clearing Company Limited ("HKSCC")[1] will enhance the settlement arrangements for Multi-Counter Eligible Securities in its Central Clearing and Settlement System("CCASS") by adopting a single tranche multiple counter arrangement(the “Enhancement”)on June 30, 2025 (the "Effective Date").

After the enhancement comes into effect, multiple trading currency counters will still be available on the trading front per stock as per existing trading arrangement. However, trades of different currency counters(Inter-counter trading [2] ) will only be reflected under one currency counter which will be designated as the domain settlement counter. In other words, market contracts for the multiple trading counters of the same Multi-counter Eligible Security will only be reflected under the domain settlement counter for subsequent post-trade processing.

All Multi-counter Eligible Securities, e.g. DCS and multi-counter ETP, will be cleared and settled under the Enhancement.

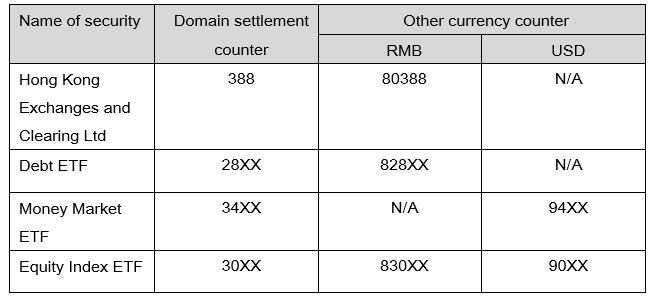

Generally, the stock code of the trading counter in HKD (or in the case where a Multi-counter Eligible Security has no such trading counter, the stock code of other trading counter as designated by HKSCC from time to time) will be used as the domain stock code. As shown in the following table.

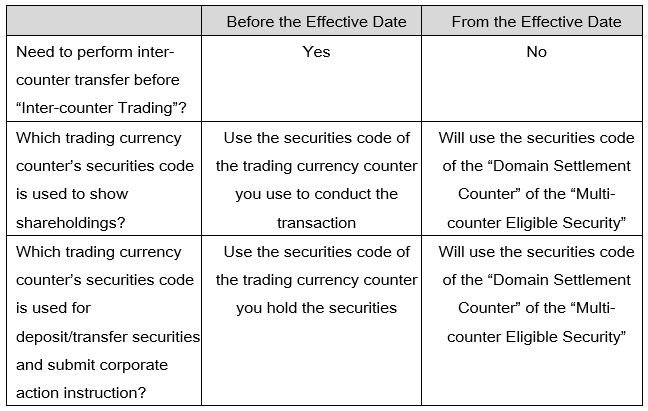

In response to the Enhancement, our company will make the following adjustments for the “Multi-counter Eligible Securities”:

Arrangement of Conversion of Existing Shareholdings of “Multi-counter Eligible Securities”

As HKSCC will conduct a shareholding conversion of all Multi-Counter Eligible Securities on 28 June 2025, converting holdings in other currency counters to holdings in the Primary Settlement Counter, we will also convert your holdings in other currency counters of Multi-Counter Eligible Securities to holdings in the Primary Settlement Counter on that day.

After the shareholding conversion is completed, you can view the converted shareholding by logging into the BOCI App or BOCI website (click "Trading" > "Position"). The daily and monthly statements issued by the Company will also show the relevant records.

Examples

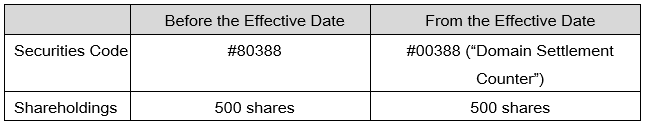

1. Customer places an order to buy 500 shares of #80388. After execution, the shareholdings will be shown as below:

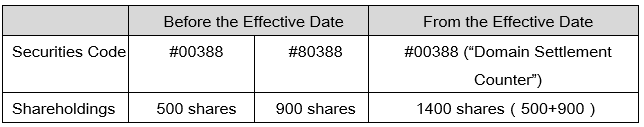

2. Customer places orders to buy 500 shares of #00388 and 900 shares of #80388. After execution, the shareholdings will be shown as below:

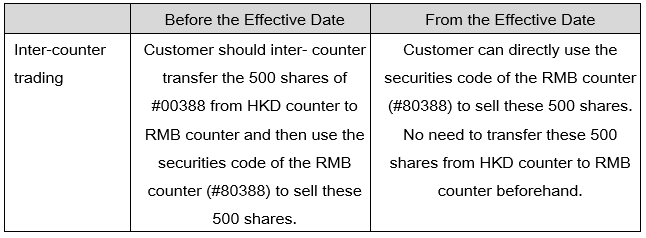

3. Customer has bought 500 shares of #00388 before and wants to sell these 500 shares through the RMB counter:

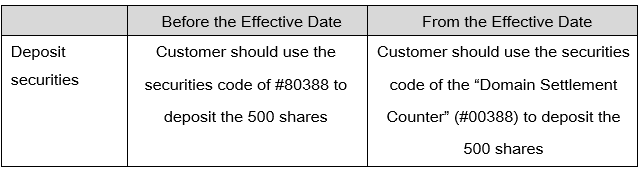

4. Customer transfer 500 shares of #80388 from another bank to the Bank:

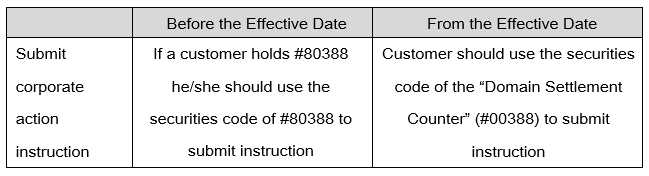

5. Customer submit corporate action instruction (Relevant shareholder equity is unaffected) :

For details of transaction fees and charges for "Multi-Counter Eligible Securities", please visit our website www.bocionline.com. If you have any questions, please contact your account manager, investment service representative or call our customer service hotline (852) 2718-9666.

In the event of any discrepancy between the Chinese and English versions, the Chinese version shall prevail.

Thank you for your continued trust in our services.

Sincerely, BOCI Securities Limited

June 26, 2025

[1] Multi-counter Eligible Securities means Eligible Securities of the same class of an Issuer which have been approved or accepted for listing and trading on the Exchange in different Eligible Currencies under separate stock code numbers in accordance with Rule 501, and a “Multi-counter Eligible Security” shall be construed accordingly.

[2] Inter-counter trading means buying in one counter and selling in another counter as two independent transactions, even though both transactions involve the same security.