Please 〈Click here〉 to download the video

![]() Option Terminology

Option Terminology

Option: The right, but not the obligation, for the holder to buy or sell a certain securities, at a certain rate, at / by a certain date in the future.

Call: The right to buy the underlying security.

Put: The right to sell the underlying security.

Investors can buy or sell call or put option.

Buy (Call or Put) Option: Investors pay premium.

Sell (Call or Put) Option: Investors receive premium.

![]() Payoff Diagram

Payoff Diagram

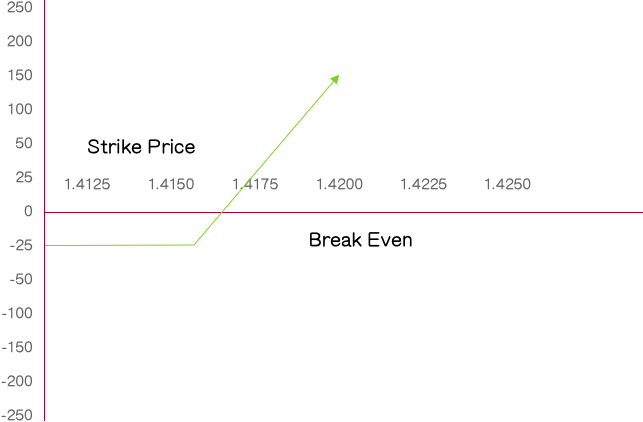

1. Long Call

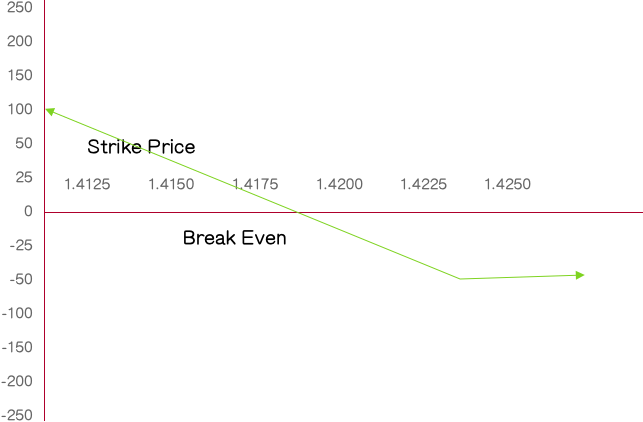

2. Long Put

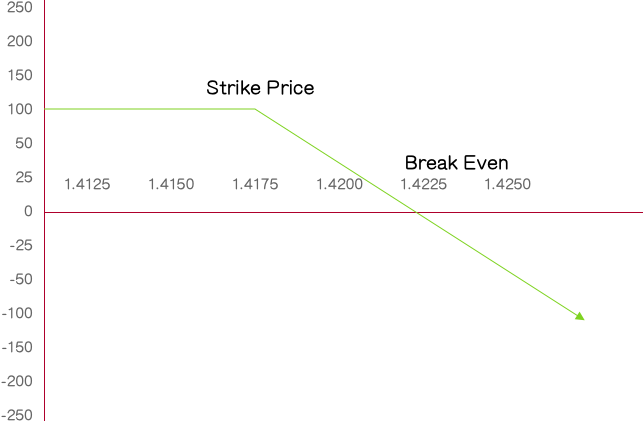

3. Short Call

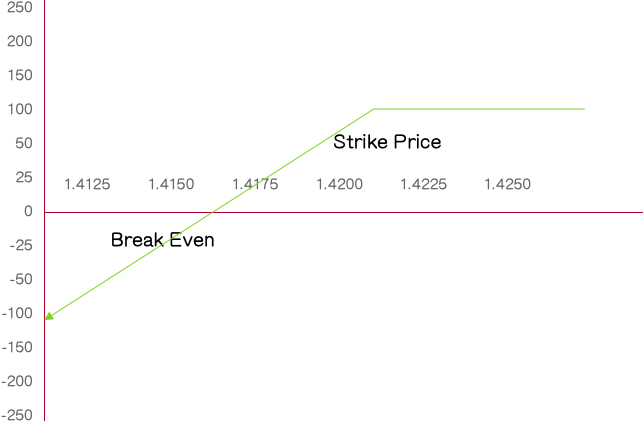

4. Short Put

![]() Risks for Option Trading

Risks for Option Trading

Transactions in options carry a high degree of risk. Purchasers and sellers of options should familiarize themselves with the type of option (i.e. put or call) which they contemplate trading and the associated risks. Investor should calculate the extent to which the value of the options must increase for his position to become profitable, taking into account the premium and all transaction costs.

The purchaser of options may offset or exercise the options or allow the options to expire. The exercise of an option results either in a cash settlement or in the purchaser acquiring or delivering the underlying. If the purchased options expire worthless, the Investor will suffer a total loss of his investment which will consist of the option premium plus transaction costs. If the investor is contemplating purchasing deep-out-of-the-money options, he should be aware that the chance of such options becoming profitable ordinarily is remote.

Selling (“writing” or “granting”) an option generally entails considerably greater risk than purchasing options. Although the premium received by the seller is fixed, the seller may sustain a loss well in excess of that amount. The seller will be liable for additional margin to maintain the position if the market moves unfavorably. The seller will also be exposed to the risk of the purchaser exercising the option and the seller will be obligated to either settle the option in cash or to acquire or deliver the underlying interest. If the option is “covered” by the seller holding a corresponding position in the underlying, the risk may be reduced. If the option is not covered, the risk of loss can be unlimited.

![]() Option Trading

Option Trading

Call / Put

Long / Short

Tenor

Strike Price

Fixing Date (based on closing price)

Delivery Method (e.g. physical delivery)

Notional Amount

Barrier Level (Knock In and/or Knock Out) – for barrier option only

| Trade Date | 4 May 2012 (Friday) |

|---|---|

| Fixing | 4 Jun 2012 (Monday) |

| of Shares | 1,000,000 shares |

| Spot Price | $16.43 |

| Strike Price | 105% of Spot (i.e. 17.252) |

| Premium | 0.70% (before commission) |

| Commission | 0.10% (i.e. investor receives 0.60%) |

| Trade Date | 4 May 2012 (Friday) |

|---|---|

| Fixing Date | 4 Jun 2012 (Monday) |

| of Shares | 100,000 shares |

| Spot Price | $92.60 |

| Strike Price | 100% of Spot (i.e. $92.60) |

| Premium | 2.81% |

| Commission | 0.19% (i.e. investor pays 3.00% premium in total) |

![]() Factors Affecting Option Price

Factors Affecting Option Price

Share price

Strike Price

Tenor

Interest Rate

Implied Volatility

- Volatility is not constant and changes from time to time

- Volatility & Time Period

- Across different stocks

![]() Risk of Investment and Investment Suitability

Risk of Investment and Investment Suitability

Investment involves risk. The price of a Derivative Product may fluctuate, sometimes dramatically; it may move up or down and may even become valueless. It is likely that loss may be incurred rather than profit made as a result of buying and/or selling a particular Derivative Product. Past performance figures are not indicative of future performance. The Investor should carefully read the term sheets (for Derivative Products) and other relevant documents for details before making any investment decisions, and thereafter, should regularly check for update of information relating to the Derivative Products.

Derivative Products are complex and involve different types of risks. The risk of loss resulting from investments in such Derivative Products can be substantial with a total loss of capital value. The Investor should: (a) study and understand the structure of the Derivative Products before placing any orders; and (b) have prior experience with investment in the Derivative Products and fully understand the associated risks before making a decision to invest in such products and ensure that the products are suitable in light of his financial position and investment objectives.

![]() Specific Risk of Investing in Derivative Products

Specific Risk of Investing in Derivative Products

Derivative Products often involve a high degree of gearing, so that a relatively small movement in the price of the underlying securities results in a disproportionately large movement in the price. The values of Derivative Products are not fixed, but fluctuate with the market, which may be influenced by many factors, including changes in the economic and/or political environment. The prices of Derivative Products can therefore be volatile.

a) Investors should notbuy a Derivative Product unless it is prepared to sustain a total loss of the investment plus any commission orother transaction charges.

b) While Derivative Products are unexercised and if their underlying securities are suspended from trading on the relevant stock exchanges, they may be suspended from trading for a similar period of time as their underlying securities。

c) Depending on the structure of a particular Derivative Product, an investor may be obligated to accept delivery or make delivery (as the case may be) of the underlying securities if the conversion price is triggered or pursuant to the terms and conditions of the relevant agreement, contract or confirmation of the subject Transaction. Depending on the market conditions, an investor may be obligated to accept delivery of the underlying securities at a price which is above the market price such securities or to make delivery of the underlying securities at a price which is below the market price of such securities and losses may occur resulting from such actions which can be substantial. The loss resulting from investing in such Derivative Products can be over and above the initial amounts invested to a substantial extent.

d) If there is an extraordinary event or an adjustment event such a stock split, issue of bonus shares or other unexpected event that changes the number, value or weighting of issued shares of the underlying stock, the counter-party/calculation agent may adjust the contract terms, at its sole discretion, to reflect the new market conditions. This may include unwinding the contract. The investor should seek independent advice from professional parties in the event of such extraordinary events or adjustments.

e) Early termination prior to maturity is possible subject to the terms and conditions governing the Derivative Product and prevailing market terms and conditions.

f) The value of the Derivative Products may be reduced due to any downgrades by rating agencies such as Moody’s Investors Inc. or Standard & Poor’s Rating Services.

g) Structured products are formed by combining two or more financial instruments and may include one or more Derivative Products. Structured products may carry a high degree of risk and may not be suitable for many members of the public, as the risks associated with the financial instruments or Derivative Products may be interconnected. As such, the extent of loss due to market movements can be substantial. Prior to engaging in structured product Transactions, the Investor should understand the inherent risks involved. In particular, the various risks associated with each financial instrument or Derivative Product should be evaluated separately as well as taking the structured product as a whole. Each structured product has its own risk profile and given the unlimited number of possible combinations, it is not possible to detail in this RDS all the risks which may arise in any particular case. The Investor should note that with structured products, buyers can only assert their rights against the issuer. Hence, particular attention needs to be paid to issuer risk. The Investor should therefore be aware that a total loss of his investment is possible if the issuer should default。

h)Equity-linked instruments (“ELI”) carries a high degree of risk. ELIs are products combining notes/deposits with stock options which may allow a bull, bear or strangle (i.e. trading range) bet. The return component of ELI is based on the performance of a single equity security, a basket of equity securities, or an equity index. ELI may come in different forms: equity-linked notes, equity-linked deposits and equity-linked contracts. The maximum return on investment is usually limited to a predetermined amount of cash, an investor stands to potentially lose up to the entire investment amount if the underlying share price moves substantially against the investor’s view. The Investor should be able to understand the risks he is bearing before investing in ELIs.

i)The prices of the underlying securities of Derivative Products fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. Accordingly, it is as likely that loss will be incurred rather than profit made as a result of buying or selling Derivative Products. In particular, for some Derivative Products such as accumulators, depending on market conditions, an investor may be obligated to accept delivery of the underlying securities at a price which is above the market price of such securities and loss may occur resulting from such action which can be substantial. Similarly, for some Derivative Products such as decumulators, an investor may be obligated to make delivery of the underlying securities at a price which is below the market price of such securities and loss may occur resulting from such action which can be substantial. The loss resulting from investing in such Derivative Products can be over and above the initial amounts invested to a substantial extent.

![]() Information for Retail Investors Located in the European Economic Area

Information for Retail Investors Located in the European Economic Area

The EU Regulation on key information documents for packaged retail and insurance-based investment products (“PRIIPs Regulation”), which came into effect on 1 January 2018, states that a key information document (“KID”) must be provided to retail investors located in the European Economic Area (“EEA”) who are sold a packaged retail and insurance-based investment product (“PRIIP”).。

Options Contracts traded on the Stock Exchange of Hong Kong Limited and the Hong Kong Futures Exchange Limited (collectively the “HKEX”) fall within the definition of a PRIIP and accordingly the HKEX has produced a KID for the relevant types of products. If you are located in the EEA, please kindly read the KID at the following HKEX’s website under section HKEX Derivatives Information for Overseas Investors before trading:

http://www.hkex.com.hk/Services/Trading/HKEX-Derivatives-Information-for-Overseas-Investors?sc_lang=zh-HK

Derivatives Trading in HKFE

Long Call Option

Long Put Option

Short Call Option

Short Put Option

Derivatives Trading in SEHK

Long Call Option

Long Put Option

Short Call Option

Short Put Option

Disclaimer

This presentation material is issued, delivered, provided or distributed by BOC International Holdings Limited or any of its subsidiaries or affiliates (collectively, the “BOCI Group”) to selected recipients or addressees。

BOC International Holdings Limited is a wholly-owned subsidiary of the Bank of China.As wholly-owned and managed by BOC International Holdings Limited, BOCI Securities is also a licensed corporation to carry on Type 1 (Dealing in Securities), Type 2 (Dealing in Futures Contracts), Type 4 (Advising on Securities) and Type 5 (Advising on Futures Contract) regulated activities for the purposes of the Securities and Futures Ordinance (Cap.571) (CE No.:AAC298) and is also an Exchange Participant of Stock Exchange of Hong Kong Limited and Hong Kong Futures Exchange Limited.

This presentation material and the products or services referred herein (collectively, the “Products”), are not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to any law or regulations or would subject any member of BOCI Group to any registration or licensing requirement.Recipients and addressees of this presentation material possess or accept or use this presentation material and the Products only to the extent permitted by the applicable law and regulations, and should be aware of and observe all such applicable law and regulations.

This presentation material is intended for general reference only and should not constitute or be regarded as an offer or solicitation of an offer or a recommendation or the basis for any contract, to sell or to purchase or to subscribe for or to invest in or to enter into the Products. The services mentioned in this presentation material may be subject to legal restrictions in certain countries and may therefore not be on offer in their entirety everywhere.Contents of this presentation material may be amended from time to time without prior notice.Nothing in this presentation material constitutes investment, legal, accounting, tax or other advice nor a representation that any product, service, investment or investment strategy is suitable for any person. The price of financial products may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling financial products. It is not possible for this presentation material to disclose all the risks and other significant aspects associated with the Products.Each prospective investor should consult independent professional advisers before making investment decision, in particular, in determining the suitability and assessing the investment risks of any product or service.

To the extent permitted by applicable law and regulations, BOCI Group disclaims liability for any error, omission or inaccuracy of the contents of this presentation material and any loss arising from the use of or reliance on this presentation material.

This presentation material is confidential and protected by copyright.No part of this presentation material or its contents may be modified, reproduced, transmitted or distributed by any means for any use without BOCI Group’s prior written consent.