Please 〈Click here〉 to download the video

What is ELN?

What is ELN?· It is a structured (derivative linked) product, wrapped in Note Form, which is linked to the performance of underlying stock(s).

· Provides the potential to earn yield on the Note.

· Not principal protected, and in case the price of underlying stock moves unfavorably, losses can result, and in the worst case, the amount of loss could equal the investment amount.

Risk of Equity Link Note (“ELN”)

Risk of Equity Link Note (“ELN”)| Market Risk | Structured Product is not principal protected.Investor needs to bear the risk from share price fluctuations, market volatility, corporate action/ extraordinary event and issuer risk. Such changes may result in the price of the underlying moving adversely to the interests of an investor negatively impacting on the return on the structured products. |

|---|---|

| Capital at Risk | This is also a risk of the underlying shares moving in an unfavorable direction as investor expects and thus resulting in partial or fully loss of the principal amount. |

| Price Adjustment | Investor needs to aware that corporate action or extraordinary events in relation to the underlying may occur which have a dilutive effect on the value of the underlying and the redemption amount on maturity date.In certain circumstances, the Issuer has discretion as to the adjustments that it makes, if any, following corporate events. |

| Potential returnmaybe limited | The yield for equity linked note is normally higher than those from fixed deposit but the potential return maybe capped by the yield of that equity linked note which is preset by the Issuer. |

| Liquidity Risk | There might not be a liquid secondary market in the structured products. Structured products do not trade on any exchange, and may be illiquid. As a result, it may be impossible for the investor of the structured products to sell it to the Issuer, any of its affiliates, another purchaser or dealer and there is no central source to obtain current prices from other dealers.Early termination costs may be significant. |

| Issuer’s discretion to adjust terms & conditions early terminate the product | If there is unexpected events in relation to the structured product (e.g. merger & acquisition, bankruptcy,nationalization, delisted, split/ merge of the underlying share or any event that have dilutive or concentrative effect on the value of the underlying share), the Issuer has discretion to adjust the terms & conditions of the structured products following such unexpected events. Besides, the Issuer can also choose to early terminate the product and determine a fair market price so as to return to the investor and may have adverse effect on your potential return. |

| Credit Risk | Investor has to bear the credit risk of the issuer. If the issuer defaults, the investor may not be able to recover part or all of the principal amount. |

Sample Features of (Non Retail) Normal Bull ELN

Sample Features of (Non Retail) Normal Bull ELN· Eligible stocks(listed stocks)

· Strike: 100% of Spot Price or below (depends on underlying)

· Tenor : One month or longer

· Settlement Date: Trade Date + 14 Calendar Days (can customize as T + 7 Calendar Days)

· Fixing / Observation Date

· Maturity Date : Fixing Date + 1 Settlement Cycles (2 Business Days for HK stocks)

· Note price: at discount (less than 100%) and investor receive 100% at Maturity Date

Illustrative Example of Bull ELN

Illustrative Example of Bull ELN| Tenor | 1 month (32 days) |

|---|---|

| Trade Date | 28 May 2020 |

| Settlement Date | 11 Jun2020 |

| Observation Date | 9 Jul 2020 (Observation at market close) |

| Maturity Date | 13 Jul 202 |

| Spot | $6.60 |

| Strike Level | 92% of Spot |

| Note Price | 98.76% |

| Yield | 14.32% p.a. |

| Underlying Share | WWW Co Ltd |

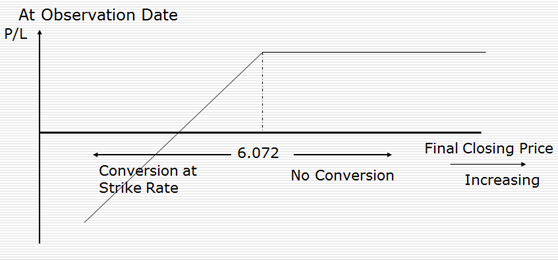

On Observation Date:

· If closing stock price of WWW Co Ltd > Strike Price ($6.072), investor receives 100%

· If closing stock of WWW Co Ltd <= Strike Price ($6.072), investor receives physical delivery of WWW Co Ltd at Strike Price (No. of stocks = 100% of Notional / Strike Price)

Stamp duty & transaction levy are paid by investor in case of delivery.

Yield Calculation:

= (100 / Note Price – 1) x 100% x 365 / No. of days

=(100 / 98.76 – 1) x 100% x 365 / 32 days

= 14.32% p.a.

Illustrative Example of Bull ELN in Diagram

Illustrative Example of Bull ELN in Diagram

Other Variations of ELN

Other Variations of ELN(Callable) Range Accrual Note

· Coupon is paid if the underlying closes above the barrier.

· Coupon rate determination usually on daily basis while knock-out / call event is usually on daily or monthly basis.

· This type of Note has longer tenor and includes call feature.The Note can terminate earlier than the stated maturity dateif call condition is satisfied (when the stock price closes at or above the knock-out / call price).

· Offer price is in 100% instead of discount.

Continuous KO Bull Equity-Linked Note

· Embedded put option: Investing in KO ELN is similar to selling a put option on an underlying stock and at the same time placing a deposit with the ELN issuer.

· Knock-Out feature allows early redemption if underlying’s price trades at or above KO level.Intraday price movement will be observed for knock-out feature, thus it is easier for early redemption than day-end observed Knock out ELN.

· The yield of KO ELN will be lower than vanilla Bull ELN (with the same strike and tenor).

· The price of underlying asset may continue to decline after the investor takes delivery of the underlying stock.

· Non-principal protected.

· Investor has full downside exposure.

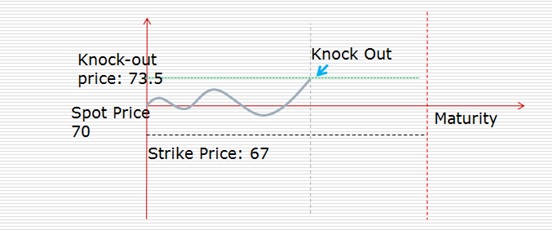

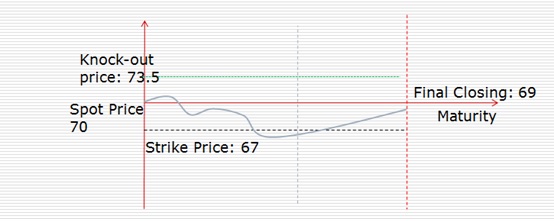

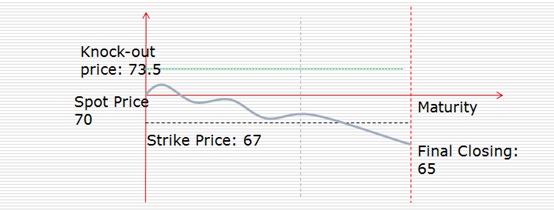

Example: Continuous KO Bull Equity-Linked Note

Example: Continuous KO Bull Equity-Linked Note| Notional Amount | $1,000,000.00 |

|---|---|

| Underlying Stock | ABC Co Ltd |

| Price | 97.29% |

| Settlement Amount | $972,900.00 |

| Maturity | T + 45 (31 – day life) |

| Strike (Exercise) Price | $67.00 (95.71% of spot) |

| KO Price | $73.50 (105% of spot) |

| Spot Price | $70.00 (as at time of execution) |

| Early Redemption | If underlying's price > KO Price at any time during the tenor, structure is early redeemed with 100% of notional amount. |

| Final Settlement | If KO event has not occurred and if the closing price of underlying is higher than strike price, investor receives 100% of the notional amount. Otherwise, investor receives physical delivery of shares at strike price. |

| ELN Annualized Yield | 32.80% p.a. |

Scenario 1

During the tenor of investment, the underlying’s price rallies and reach knock-out price.Since the note is under continuous observation,as soon as the underlying’s price hits the knock out barrier, investor will be early redeemed with 100% of the notional amount.

Scenario 2

During the tenor, the underlying’s price movement shows significant fluctuation, and finally closes at 69.Since the closing price is higher than the strike price, investor can get back 100% of the notional amount.The yield for investor is 32.80% per annum.

Scenario 3

Since the trade day, the underlying’s price performs poorly and plunges down to 65.As the price closes below strike price, investor .

Range Accrual Laggard Note

Range Accrual Laggard NoteIf all the underlyings’ prices stay above (at market close) their respective strike prices, investor can obtain the potential variable coupon on a daily accrual basis (exchange business days only).

If the laggard underlying’s price is higher than its knock-out barrier on the periodic valuation date, the note will be early redeemed with 100% of the principal + accrued coupon; otherwise, the note continues.

In case where not all the underlyings' prices are above the strike price, the note may not pay coupon on periodic payment date.

Key Features

· The note can be priced with or without guaranteed coupon.

· Coupons are accrued for each exchange business day that all the underlyings close at or above their respective strike levels.

· Basket of more than 1 underlying can enhance the coupon return.Such enhanced coupon is to compensate the increased downside risk of an investor receiving physical delivery of the underlying at maturity at a strike price that is higher than market price.

Sample Terms

| Issue Price | 100% of Denomination |

|---|---|

| Tenor | 1 Year |

| Underlying | |

| Coupon 1st Period | The first Knock Out observation date is set at the end of Coupon Period 1. Coupon rate is 12%p.a.of the Denomination , hencethe 1stperiod couponis 1% flat which is guaranteed 4% of the Denomination (flat) , the 1st period is the guaranteed period |

| Coupon 2nd to f (f means last period) subject to no early redemption | 12% x (n_i/N_i) x denominationx Time Ratio n_i: Total number of scheduled trading days in relevant period (2 to f) in which the closing price of all the underlyings stays above the Strike Price N_i: Total number of scheduled trading days in relevant quarter |

| Knock-out Price | 100% of Spot Price |

| Early Redemption | If closing price of the laggard underlying is at or higher than the knock-out price at valuation date of the nth period (n can be as early as 1st period end), the note will be redeemed in cash at 100% + accrued interest. |

| Redemption at Maturity | If KO event has not occurred, and the closing price of the laggard underlying is at or above than strike price, the note will be redeemed at 100% + accrued interest (if any). Otherwise, investors receive physical delivery of laggard shares at strike price. |

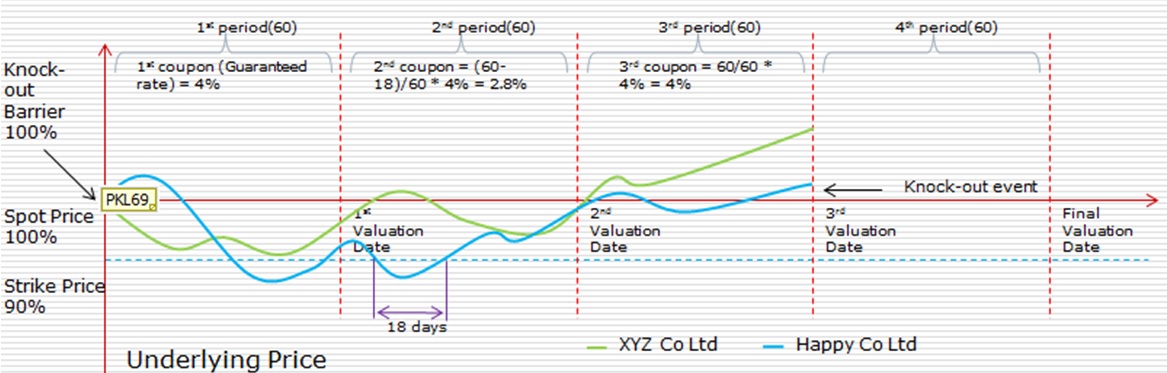

Scenario 1

On the 3rdvaluation date, the closing price of the laggard stock is over 100% of Spot Price.The note will be early redeemed, investor willreceive 100% principal on the 3rdcoupon payment date.Total coupon received = 4% + 2.8% + 4% = 10.8%.

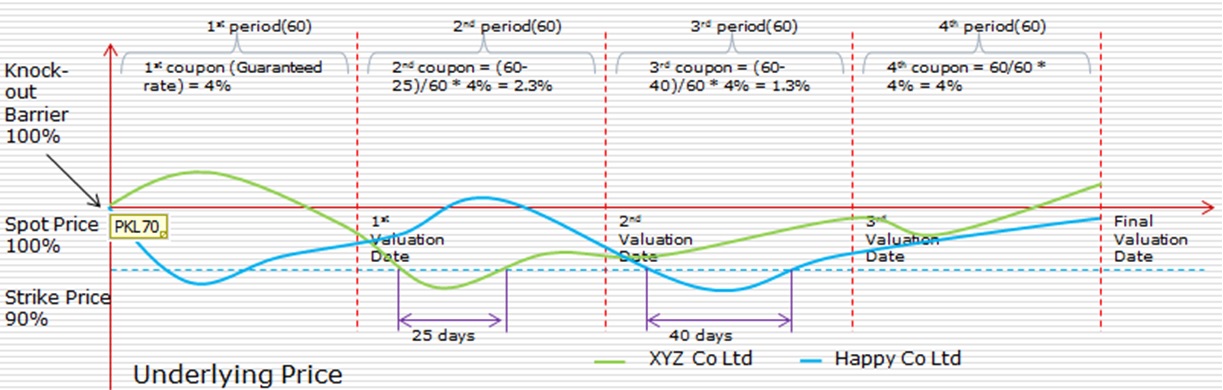

Scenario 2

There was no knock-out event during the tenor.On final valuation date, the laggard stock closes between spot and strike level.Investorreceives 100% of the principal amount + coupon return (4% + 2.3% + 1.3% + 4% = 11.6%).

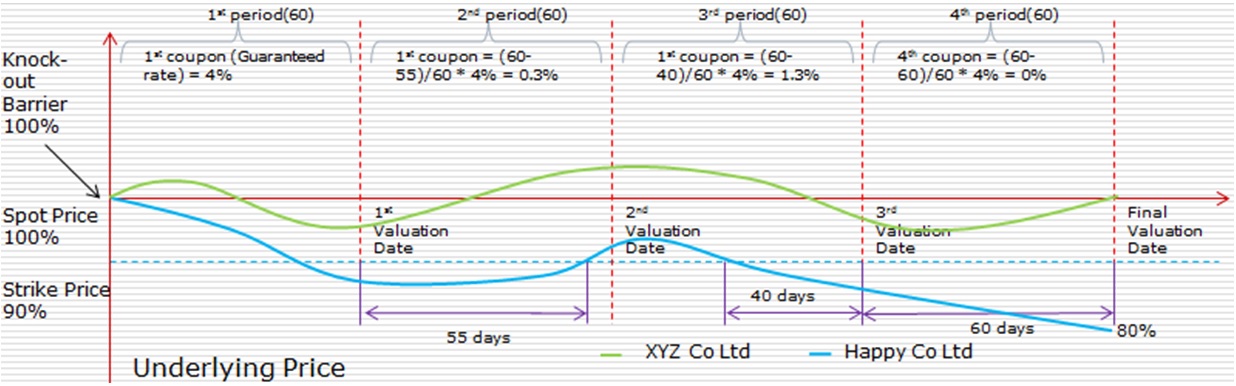

Scenario 3(Worst Case)

The laggard underlying was traded below par for an extended period since trade date.It was fixed at 80% of spot on final valuation date,which is below strike level (90%).At maturity, investor receives physical delivery of underlying shares at 90% strike, number of shares =Principal Amount of the Note / Strike Price.

How to determine the coupon in each period

How to determine the coupon in each period· Revisit Scenario 2, the first month coupon is guaranteed.No matter the closing prices of both stocks in the basket, the coupon rate is guaranteed to pay to investors, i.e. 4% flat to investors.

· In the 2nd period, the total of 25 days out of 60 exchange business days that either or both stocks below their respective strikes.Coupon rate is a proportion of 4%, i.e. 4% x (60-25)/60 = 2.33% flat.

· Coupon determination is independent of previous coupon paid.

· In case where at least one of the underlying is below the strike price for the entire period, investors can only get the guaranteed coupon (if any) and no coupon thereafter.

Risk

Risk· Market Risk

· Interest Amount – Interest amount depend on the performance of the share

· Redemption Risk – this product is not capital protected

· Liquidity and early redemption risk

· Credit Risk

Risk of Investment and Investment Suitability

Risk of Investment and Investment Suitability1. Investment involves risk. The price of a Derivative Product may fluctuate, sometimes dramatically; it may move up or down and may even become valueless. It is likely that loss may be incurred rather than profit made as a result of buying and/or selling a particular Derivative Product. Past performance figures are not indicative of future performance. The Investor should carefully read the term sheets (for Derivative Products) and other relevant documents for details before making any investment decisions, and thereafter, should regularly check for update of information relating to the Derivative Products.

2. Derivative Products are complex and involve different types of risks. The risk of loss resulting from investments in such Derivative Products can be substantial with a total loss of capital value. The Investor should: (a) study and understand the structure of the Derivative Products before placing any orders; and (b) have prior experience with investment in the Derivative Products and fully understand the associated risks before making a decision to invest in such products and ensure that the products are suitable in light of his financial position and investment objectives.

Specific Risk of Investing in Derivative Products

Specific Risk of Investing in Derivative Products1. Derivative Products often involve a high degree of gearing, so that a relatively small movement in the price of the underlying securities results in a disproportionately large movement in the price. The values of Derivative Products are not fixed, but fluctuate with the market, which may be influenced by many factors, including changes in the economic and/or political environment. The prices of Derivative Products can therefore be volatile.

2. a)Investors should not buy a Derivative Product unless it is prepared to sustain a total loss of the investment plus any commission or other transaction charges

b)While Derivative Products are unexercised and if their underlying securities are suspended from trading on the relevant stock exchanges, they may be suspended from trading for a similar period of time as their underlying securities

c)Depending on the structure of a particular Derivative Product, an investor may be obligated to accept delivery or make delivery (as the case may be) of the underlying securities if the conversion price is triggered or pursuant to the terms and conditions of the relevant agreement, contract or confirmation of the subject Transaction. Depending on the market conditions, an investor may be obligated to accept delivery of the underlying securities at a price which is above the market price such securities or to make delivery of the underlying securities at a price which is below the market price of such securities and losses may occur resulting from such actions which can be substantial. The loss resulting from investing in such Derivative Products can be over and above the initial amounts invested to a substantial extent.

d) If there is an extraordinary event or an adjustment event such a stock split, issue of bonus shares or other unexpected event that changes the number, value or weighting of issued shares of the underlying stock, the counter-party/calculation agent may adjust the contract terms, at its sole discretion, to reflect the new market conditions. This may include unwinding the contract. The investor should seek independent advice from professional parties in the event of such extraordinary events or adjustments.

e) Early termination prior to maturity is possible subject to the terms and conditions governing the Derivative Product and prevailing market terms and conditions.

f) The value of the Derivative Products may be reduced due to any downgrades by rating agencies such as Moody’s Investors Inc. or Standard & Poor’s Rating Services.

g) Structured products are formed by combining two or more financial instruments and may include one or more Derivative Products. Structured products may carry a high degree of risk and may not be suitable for many members of the public, as the risks associated with the financial instruments or Derivative Products may be interconnected. As such, the extent of loss due to market movements can be substantial. Prior to engaging in structured product Transactions, the Investor should understand the inherent risks involved. In particular, the various risks associated with each financial instrument or Derivative Product should be evaluated separately as well as taking the structured product as a whole. Each structured product has its own risk profile and given the unlimited number of possible combinations, it is not possible to detail in this RDS al。l the risks which may arise in any particular case. The Investor should note that with structured products, buyers can only assert their rights against the issuer. Hence, particular attention needs to be paid to issuer risk. The Investor should therefore be aware that a total loss of his investment is possible if the issuer should default.

h)Equity-linked instruments (“ELI”) carries a high degree of risk. ELIs are products combining notes/deposits with stock options which may allow a bull, bear or strangle (i.e. trading range) bet. The return component of ELI is based on the performance of a single equity security, a basket of equity securities, or an equity index. ELI may come in different forms: equity-linked notes, equity-linked deposits and equity-linked contracts. The maximum return on investment is usually limited to a predetermined amount of cash, an investor stands to potentially lose up to the entire investment amount if the underlying share price moves substantially against the investor’s view. The Investor should be able to understand the risks he is bearing before investing in ELIs.

i)The prices of the underlying securities of Derivative Products fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. Accordingly, it is as likely that loss will be incurred rather than profit made as a result of buying or selling Derivative Products. In particular, for some Derivative Products such as accumulators, depending on market conditions, an investor may be obligated to accept delivery of the underlying securities at a price which is above the market price of such securities and loss may occur resulting from such action which can be substantial. Similarly, for some Derivative Products such as decumulators, an investor may be obligated to make delivery of the underlying securities at a price which is below the market price of such securities and loss may occur resulting from such action which can be substantial. The loss resulting from investing in such Derivative Products can be over and above the initial amounts invested to a substantial extent.

Key Risks associated with Renminbi Products

Key Risks associated with Renminbi Products1.Renminbi currency risk – Renminbi is not freely convertible at present and conversion of Renminbi through banks in Hong Kong is subject to certain restrictions.

For Renminbi products which are not denominated in Renminbi or with underlying investments which are not Renminbi denominated, such products will be subject to multiple currency conversion costs involved in making investments and liquidating investments, as well as the Renminbi exchange rate fluctuations and bid/offer spreads when assets are sold to meet redemption requests and other capital requirements (e.g. settling operating expenses).

The PRC government regulates the conversion between Renminbi and other currencies. If the restrictions on Renminbi convertibility and the limitations on the flow of Renminbi funds between PRC and Hong Kong become more stringent, the depth of the Renminbi market in Hong Kong may become further limited.

2.Exchange rate risks– the value of the Renminbi against the Hong Kong dollar and other foreign currencies fluctuates and is affected by changes in the PRC and international political and economic conditions and by many other factors. For our Renminbi products, the value of Customer’s investment in Hong Kong dollar terms may decline if the value of Renminbi depreciates against the Hong Kong dollar.

3. Interest rate risks – the PRC government has gradually liberalized the regulation of interest rates in recent years. Further liberalization may increase interest rate volatility. For Renminbi products which are, or may invest in, Renminbi debt instruments, such instruments are susceptible to interest rate fluctuations, which may adversely affect the return and performance of the Renminbi products.

4.Limited availability of underlying investments denominated in Renminbi – For Renminbi products that do not have access to invest directly in Mainland China, their available choice of underlying investments denominated in Renminbi outside Mainland China may be limited. Such limitation may adversely affect the return and performance of the Renminbi products.

5.Projected returns which are not guaranteed – For some Renminbi investment products, their return may not be guaranteed or may only be partly guaranteed. Investors should read carefully the statement of illustrative return attached to such products and in particular, the assumptions on which the illustrations are based, including, for example, any future bonus or dividend declaration。

6.Long term commitment to investment products – For Renminbi products which involve a long period of investment, if Investors redeem their investment before the maturity date or during the lock-up period (if applicable), Investors may incur a significant loss of principal where the proceeds may be substantially lower than their invested amount. Investors may also suffer from early surrender / withdrawal fees and charges as well as the loss of returns (where applicable) as a result of redemption before the maturity date or during lock-up period.

7.Credit risk of counterparties – For Renminbi products invest in Renminbi debt instruments which are not supported by any collateral, such products are fully exposed to the credit risk of the relevant counterparties. Where a Renminbi product may invest in derivative instruments, counterparty risk may also arise as the default by the derivative issuers may adversely affect the performance of the Renminbi product and result in substantial loss.

8. Liquidity risk– Renminbi products may suffer significant losses in liquidating the underlying investment, especially if such investments do not have an active secondary market and their prices have large bid / offer spread.

9.Possibility of not receiving Renminbi upon redemption– For Renminbi products with a significant portion of non-Renminbi denominated underlying investments, there is a possibility of not receiving the full amount in Renminbi upon redemption. This may be the case if the issuer is not able to obtain sufficient amount of Renminbi in a timely manner due to the exchange controls and restrictions applicable to the currency.

10.The above key risks statement does not disclose all the risks and information in relation to investment in Renminbi products. For example, selling restrictions may be applicable to certain investors in accordance with the restrictions as stipulated in the relevant prospectus of the Renminbi products. Investors must therefore read the relevant prospectus, circular or any other documents in respect of each Renminbi products and carefully consider all other risk factors set out therein before deciding whether to invest.

Disclaimer

This presentation material is issued, delivered, provided or distributed by BOC International Holdings Limited or any of its subsidiaries or affiliates (collectively, the “BOCI Group”) to selected recipients or addresses.

BOC International Holdings Limited is a wholly-owned subsidiary of the Bank of China.As wholly-owned and managed by BOC International Holdings Limited, BOCI Securities is also a licensed corporation to carry on Type 1 (Dealing in Securities), Type 2 (Dealing in Futures Contracts), Type 4 (Advising on Securities) and Type 5 (Advising on Futures Contract) regulated activities for the purposes of the Securities and Futures Ordinance (Cap.571) (CE No.:AAC298) and is also an Exchange Participant of Stock Exchange of Hong Kong Limited and Hong Kong Futures Exchange Limited.

This presentation material and the products or services referred herein (collectively, the “Products”), are not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to any law or regulations or would subject any member of BOCI Group to any registration or licensing requirement.Recipients and addressees of this presentation material possess or accept or use this presentation material and the Products only to the extent permitted by the applicable law and regulations, and should be aware of and observe all such applicable law and regulations.

This presentation material is intended for general reference only and should not constitute or be regarded as an offer or solicitation of an offer or a recommendation or the basis for any contract, to sell or to purchase or to subscribe for or to invest in or to enter into the Products. The services mentioned in this presentation material may be subject to legal restrictions in certain countries and may therefore not be on offer in their entirety everywhere.Contents of this presentation material may be amended from time to time without prior notice.Nothing in this presentation material constitutes investment, legal, accounting, tax or other advice nor a representation that any product, service, investment or investment strategy is suitable for any person. The price of financial products may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling financial products. It is not possible for this presentation material to disclose all the risks and other significant aspects associated with the Products.Each prospective investor should consult independent professional advisers before making investment decision, in particular, in determining the suitability and assessing the investment risks of any product or service.

To the extent permitted by applicable law and regulations, BOCI Group disclaims liability for any error, omission or inaccuracy of the contents of this presentation material and any loss arising from the use of or reliance on this presentation material.

This presentation material is confidential and protected by copyright.No part of this presentation material or its contents may be modified, reproduced, transmitted or distributed by any means for any use without BOCI Group’s prior written consent.